Download Complete Guide in PDF File

What Is Bitcoin? A Complete Beginner’s Guide (2025 Edition)

Introduction of Bitcoin Complete Beginner’s Guide:

Bitcoin is the world’s first and most well-known cryptocurrency. Unlike government-issued money (called fiat currency), Bitcoin is digital, decentralized, and not controlled by any authority, such as a bank or government. Launched in 2009 by a mysterious figure known as Satoshi Nakamoto, Bitcoin seeks to offer a new way to manage money: peer-to-peer, transparent, and censorship-resistant.

If you’re 15 and hear about Bitcoin on social media, through friends, or on YouTube, it might seem like a tech buzzword or a get-rich-quick scheme. But Bitcoin is much more than that. It represents a revolution in the way people think about money, trust, and technology.

Learn everything about Bitcoin in this complete beginner’s guide, full course, and PDF – from Bitcoin’s history to using Binance and investing smartly. Get Bitcoin clarity with our complete information and course designed for beginners.

A Brief History of Bitcoin Complete Beginner’s Guide:

The Beginnings (2008-2009)

In October 2008, during the global financial crisis, Satoshi Nakamoto published a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” It proposed a way to send money directly from one person to another without the need for an intermediary like a bank.

On January 3, 2009, Nakamoto mined the first block of the Bitcoin blockchain, known as the “Genesis Block.” This moment marked the birth of Bitcoin and the beginning of blockchain technology.

Early Years (2010-2012)

In 2010, the first real Bitcoin transaction took place when a programmer named Laszlo Hanyecz paid 10,000 BTC for two pizzas. At the time, Bitcoin was worth just a few cents.

As more people became aware of Bitcoin, its value and use began to grow. Forums, developers, and early Bitcoin adopters began to build a community around it. The first Bitcoin exchange, Mt. Gox, was launched, allowing people to exchange BTC for dollars.

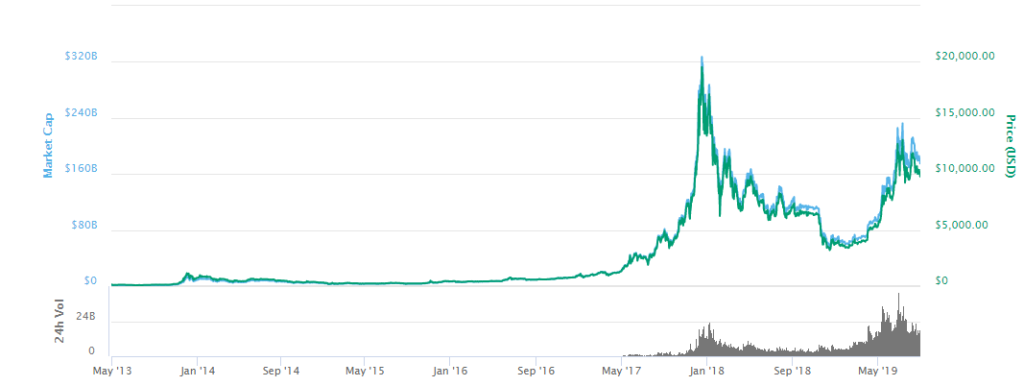

Growth and Volatility (2013-2017)

Between 2013 and 2017, Bitcoin experienced a massive surge in popularity and price. It captured the attention of mainstream media, investors, and even criminals. Its price rose from under $100 in 2013 to nearly $20,000 by the end of 2017.

However, Bitcoin also faced significant challenges, including government crackdowns, hacks into exchanges (such as Mt. Gox), and debates about its scalability.

Public Attention (2018-2021)

Bitcoin became a more popular asset during these years. Major companies such as Tesla and Square began buying Bitcoin, and countries began to seriously consider regulating or even adopting it. In 2021, El Salvador became the first country to accept Bitcoin as legal tender.

Recent Developments (2022-2025)

Bitcoin continues to evolve. With more financial institutions offering Bitcoin ETFs and countries exploring digital currencies, Bitcoin remains at the center of the global conversation about money, freedom, and technology.

Advantages of Bitcoin

1. Decentralization

Bitcoin is not controlled by any government or corporation. It operates on a network of computers (called nodes) around the world. This makes it less vulnerable to censorship or control.

2. Transparency

All Bitcoin transactions are recorded on a public ledger called the blockchain. Anyone can verify transactions, which builds trust without the need for a central authority.

3. Security

Bitcoin uses advanced cryptography, making it extremely secure. The blockchain is very difficult to tamper with, meaning that once a transaction is confirmed, it is nearly impossible to forge or alter it.

4. Limited Supply

Only 21 million bitcoins will ever exist. This limited supply differentiates it from fiat currencies, which governments can print at will. Some see Bitcoin as a hedge against inflation.

5. Financial Inclusion

Bitcoin allows unbanked people to participate in the global economy using only a smartphone and an internet connection.

Bitcoin Disadvantages

1. Price Volatility

Bitcoin’s price can fluctuate dramatically. One day it can be worth $60,000 and a few months later, drop to $30,000. This makes it risky for users and short-term investors.

2. Scalability Issues

Bitcoin can only process about 7 transactions per second, which is very slow compared to Visa or Mastercard. There are initiatives like the Lightning Network to address this problem, but it is still under development.

3. Environmental Impact

Bitcoin mining requires a lot of electricity. Critics argue that this energy consumption is harmful to the environment, although many miners are migrating to renewable energy sources.

4. Regulatory Uncertainty

Governments around the world have different opinions about Bitcoin. Some support it, others prohibit it, and others are still analyzing how it works. This creates uncertainty for both users and investors.

5. Complexity and Usability

Bitcoin can be confusing to understand and use, especially for beginners. Managing private keys, wallets, and security requires learning and responsibility.

Download Complete Guide in PDF File

Conclusion

Bitcoin is a powerful and innovative technology that challenges the traditional way we use and think about money. While it’s not perfect and continues to evolve, it has opened the door to new financial possibilities and freedom for millions of people around the world.

If you’re 15, now is a great time to start learning about Bitcoin. You don’t have to invest money, just invest your curiosity. Understanding Bitcoin can help you understand broader ideas about economics, technology, and how the world might change in the future.

Whether you see it as “digital gold,” a financial revolution, or simply a technological trend, Bitcoin is something worth exploring with care, reflection, and an open mind.

No Comments