Download Complete Guide in PDF File

US President Trump: Bitcoin removes pressure from USD

🧠 Detail about Bitcoin Moves by US President:

1. Trump’s U-turn on Bitcoin:

- President Trump has officially embraced Bitcoin. He claims it can help ease pressure on the US dollar and considers it a strategic asset for US leadership globally.

- Earlier this year (March 6, 2025), he signed an executive order mandating the creation of a Bitcoin Strategic National Reserve, funded by confiscated Bitcoin. The goal: to keep the US at the forefront of digital asset innovation.

2. Price Reaction:

- On June 29, 2025, Bitcoin surpassed $108,000, reaching intraday highs near $108,774, its best performance since March.

- Traders attributed the rally to three main factors:

- Institutional inflows: large corporations and investment funds buying Bitcoin.

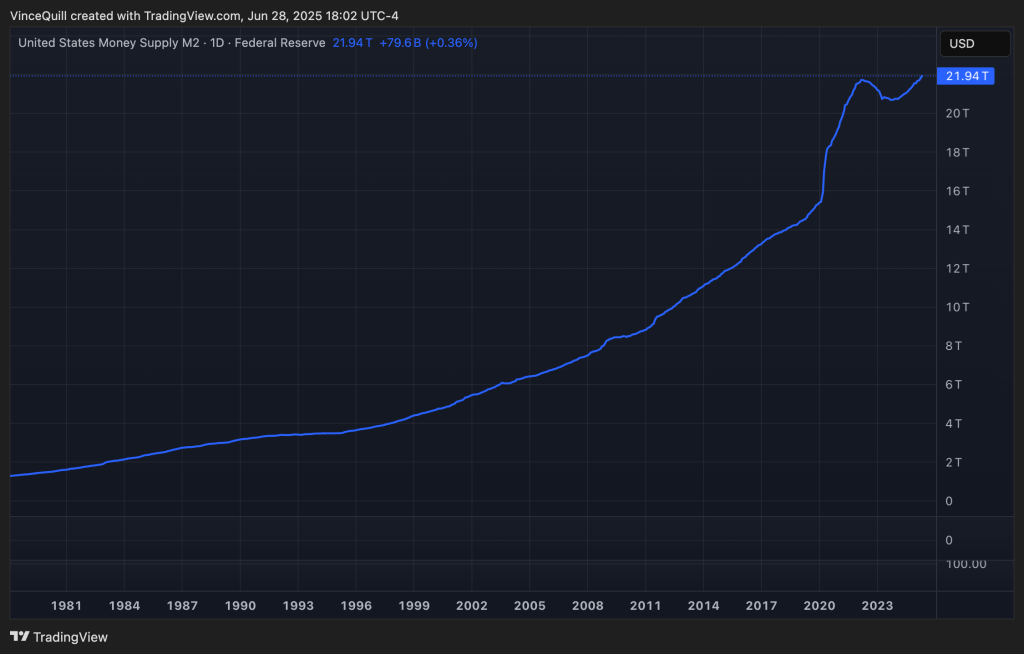

- Trump’s comments reinforce the idea that economic growth makes Bitcoin and gold more attractive amid growing debt concerns.

- ETF inflows: More Bitcoin funds purchased by traditional financial investors.

3. Global Repercussion:

- Trump’s call to establish a Bitcoin reserve in the US has prompted some states, such as Arizona, New Hampshire, and Texas, to implement their own reserve plans.

- Internationally, central banks in Asia and Europe are closely watching the situation. Some fear it could destabilize or weaken their own monetary systems.

4. Concerns and Criticism:

- Critics warn about Bitcoin’s volatility, meaning its price rises and falls rapidly. They claim that the accumulation of government and corporate reserves in cryptocurrencies could lead to severe declines.

- Economist Peter Schiff has stated that if Trump pushes Bitcoin too hard, it could “cause a collapse of the US dollar.” Senator Elizabeth Warren and others fear that a sharp drop in cryptocurrencies could harm businesses and workers, as well as cryptocurrency markets.

5. Overview:

- Since Trump’s embrace of cryptocurrencies, Bitcoin’s market capitalization has skyrocketed and its status in traditional finance has grown, making it a dominant “asset class” alongside stocks and bonds.

- But Bitcoin’s rise to public and corporate coffers—a trend called crypto treasury—brings stability and risk.

- The possibility of a national reserve for Bitcoin makes it more official and secure. However, sharp price fluctuations in cryptocurrencies still need to be managed carefully.

⚖️ Summary:

- Why prices soared: Trump’s statements and new reserve policies boosted investor confidence, pushing the price of BTC above $108,000.

- Why it matters: This signals a shift: Bitcoin is no longer just for techies; it’s now part of big finance and the American economic strategy.

- Why be cautious: Heavy reliance on cryptocurrencies can backfire if their value fluctuates too much, affecting the dollar and the broader economy.

No Comments